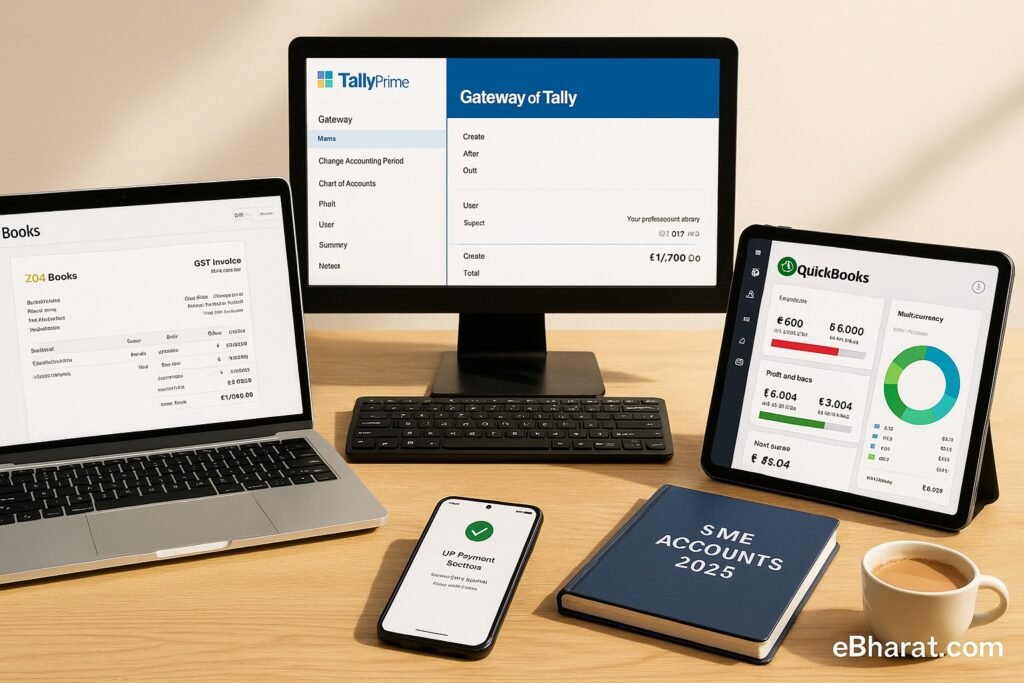

Accounting software is a make-or-break choice for Indian SMEs. In 2025, Zoho Books, Tally, and QuickBooks (if it returns) are the top names on every shortlist. Each offers different strengths—from GST compliance and UPI payments to offline reliability and global integrations. Here’s how they compare.

India Snapshot

| Feature | Zoho Books | Tally Prime | QuickBooks (Global) | Notes |

|---|---|---|---|---|

| Starting Price | ₹899/year (Basic plan) | ₹21,000 one-time license | $15/month (~₹1,250, if back) | Zoho cheapest |

| GST Compliance | Built-in GST filing + e-invoice | GST enabled, but manual uploads | GST support (if relaunched in India) | Zoho/Tally |

| Cloud Access | Fully online, mobile app | Offline; cloud only via add-ons | Cloud-based, global servers | Zoho/QuickBooks |

| Payments | Razorpay, PayU, UPI supported | Limited | Stripe, PayPal (no native UPI) | Zoho wins India |

| Multi-Currency | Yes, via Zoho Books Premium | Limited | Yes, very strong | QuickBooks |

| Support Hours | India-first support | Local partners/distributors | Global, slower in IST | Zoho/Tally faster |

Want a GST-ready, India-first accounting tool?

Start with Zoho Books

Zoho Books: Best for Compliance & Simplicity

- 100% GST-compliant with automated filing.

- e-Invoicing support included.

- Integrates with Razorpay, PayU, UPI payments.

- Affordable for SMEs: ₹899/year basic plan.

- Works on mobile (Android/iOS apps).

Best for: SMEs who want easy GST compliance and affordable cloud accounting.

Tally Prime: Best for Traditional Accountants

- One-time license (~₹21,000) + yearly renewals.

- Works offline, suitable for firms preferring desktop software.

- GST-ready but requires manual uploads to GSTN.

- Remote access only via extra add-ons.

- Strong user base among Indian CA firms.

Best for: SMEs already using Tally or with in-house accountants.

QuickBooks: Global Power, But India Exit

- Intuit shut QuickBooks India in 2023.

- Still available globally at $15/month (~₹1,250).

- Excellent for cross-border, multi-currency accounting.

- Weakness: No native UPI/Razorpay integrations for India.

Best for: Indian SMEs with overseas clients or US/EU subsidiaries.

Profitability & SME Fit

- Zoho Books: Lower cost, GST-native, UPI integrated → better ROI for India-first SMEs.

- Tally: Higher upfront cost but familiar for traditional accountants.

- QuickBooks: Not ideal for India-only SMEs, but valuable if cross-border accounting is needed.

Pros and Cons

Zoho Books Pros

- Affordable cloud plans.

- GST + e-invoice built in.

- UPI/PayU/Razorpay integration.

- India-first support.

Zoho Books Cons

- Lacks deep offline support.

- Limited without internet.

Tally Pros

- Trusted, widely used.

- Strong offline reliability.

- Large CA network familiarity.

Tally Cons

- Expensive upfront.

- Limited mobile/cloud features.

QuickBooks Pros

- Excellent global accounting.

- Multi-currency support.

- Strong integrations for SaaS/export firms.

QuickBooks Cons

- Not available in India (since 2023).

- No UPI or India-specific features.

Quick Checklist

- If GST + UPI are priorities → Zoho Books.

- If your CA team loves offline tools → Tally Prime.

- If you serve global clients → QuickBooks (via global subscription).

- Always ensure GSTN integration for compliance.

- Pick annual billing to reduce subscription costs.

Ready to simplify accounting with GST and UPI built-in? Try Zoho Books for Indian SMEs

In 2025, Zoho Books is the best fit for most Indian SMEs thanks to GST compliance, UPI integrations, and low pricing. Tally remains strong for traditional accountants, while QuickBooks is only useful for SMEs with overseas operations.